Section 179 Phase Out 2025

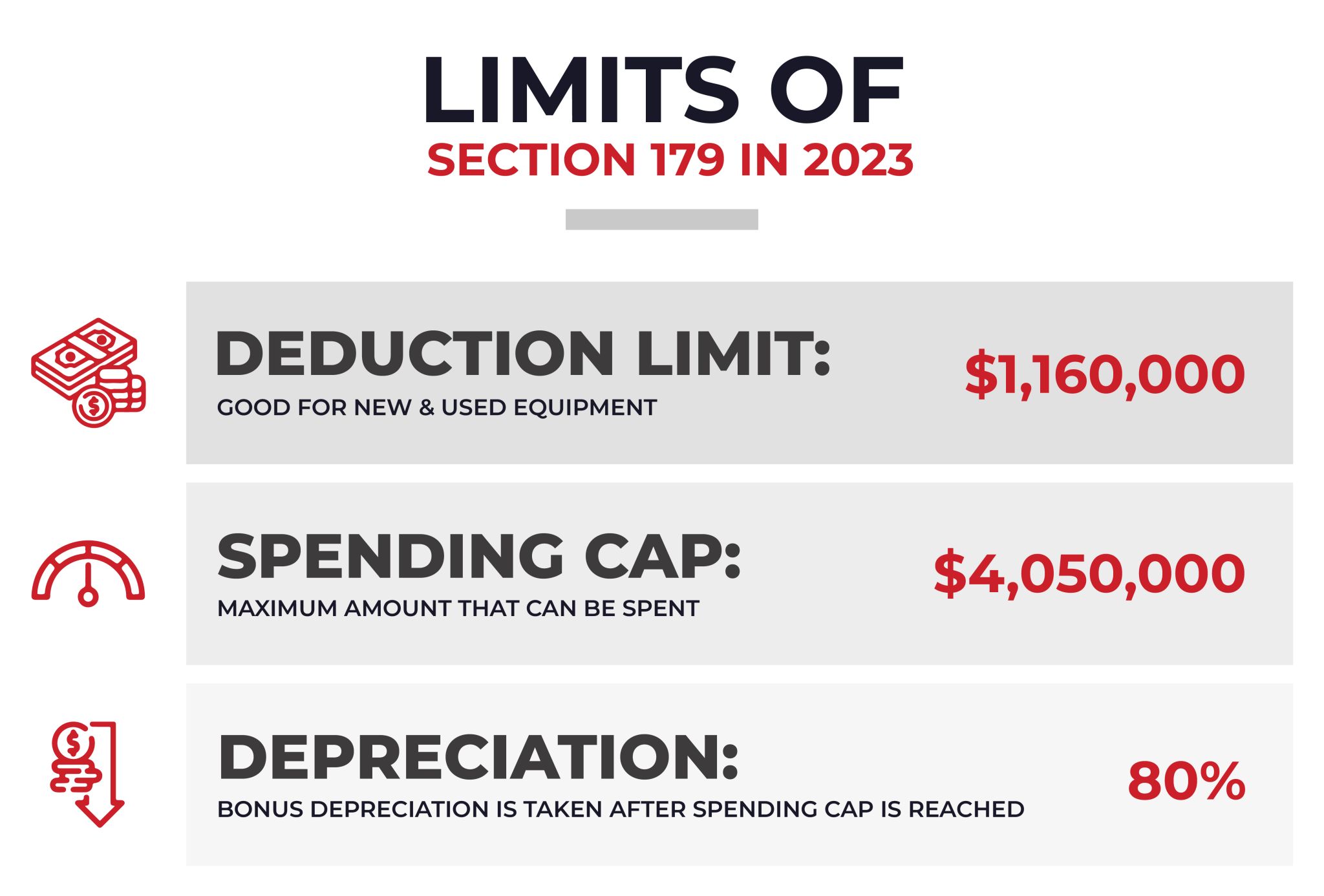

Section 179 Phase Out 2025. However, under currently enacted law, bonus depreciation is phasing out, having reduced to. For tax years beginning in 2025, the same deduction will max out at $1.25 million and begin to phase out when 2025 qualified asset additions exceed $3.13 million.

The small business jobs act would raise the maximum amount of investment eligible for section 179 expensing to $2.5 million and the point at which the policy’s benefits phase out to $4 million, expanding the policy on a. However, under currently enacted law, bonus depreciation is phasing out, having reduced to.

Section 179 Phase Out 2025 Images References :

Source: allsunypaloma.pages.dev

Source: allsunypaloma.pages.dev

Section 179 Phase Out 2025 Gilda Julissa, Under section 179 of the internal revenue code, a business may elect to expense—in other words, immediately deduct—the cost of any business property placed in service during the year, within generous limits.

Source: allsunypaloma.pages.dev

Source: allsunypaloma.pages.dev

Section 179 Phase Out 2025 Gilda Julissa, With the reduction of bonus depreciation, taxpayers should consider how the section 179 expense deduction can benefit them.

Source: www.hybridlifts.com

Source: www.hybridlifts.com

How Can Section 179 Save You Money? HyBrid Lifts, With bonus depreciation facing a complete phase out by 2026, taxpayers focused in real estate may begin to implement section 179 expense to continue deducting the full cost.

Source: gussyqninnette.pages.dev

Source: gussyqninnette.pages.dev

Section 179 And Bonus Depreciation 2025 Ilene Willyt, 179 and bonus depreciation 101.

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg) Source: rayevardelis.pages.dev

Source: rayevardelis.pages.dev

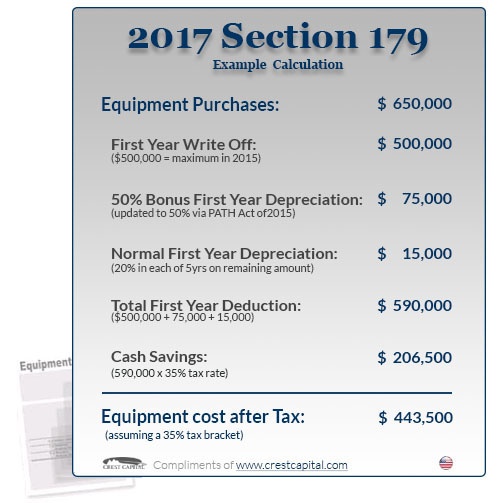

2025 Section 179 Limits Basia Norrie, Combining section 179 and bonus depreciation property owners who extended their 2023 tax filing in hopes of the return of 100% bonus depreciation should move forward using the two options available to maximize.

Source: darrequipment.com

Source: darrequipment.com

Is The Section 179 Deduction For You? Darr Equipment, What is a section 179 amended return?

Source: aggyblynette.pages.dev

Source: aggyblynette.pages.dev

179 Deduction 2025 Henka Lethia, Combining section 179 and bonus depreciation property owners who extended their 2023 tax filing in hopes of the return of 100% bonus depreciation should move forward using the two options available to maximize.

Source: rayevardelis.pages.dev

Source: rayevardelis.pages.dev

2025 Section 179 Limits Basia Norrie, Expense amount increased to $1,000,000;

Source: aggyblynette.pages.dev

Source: aggyblynette.pages.dev

179 Deduction 2025 Henka Lethia, Using bonus depreciation, you can deduct a certain percentage of the cost of an asset in the first year it was purchased, and the remaining cost can be deducted over several.

Source: blog.thermwood.com

Source: blog.thermwood.com

Thermwood Corporation Blog Schedule 179, Businesses may want to accelerate.

Category: 2025